The appropriations process is in full swing in Congress, which will determine Fiscal Year 2023 funding levels for historic preservation and we need your help! Sen. Kirsten Gillibrand (D-NY) and Sen. Bill Cassidy (R-LA) are leading the bipartisan FY23 Historic Preservation Fund (HPF) Dear Colleague Letter in the Senate. The Senate letter, like the House letter, requests $200 million in funding for the HPF, the same level Preservation Action advocated for during Historic Preservation Advocacy Week and would be a record level of funding for the program. The request includes much-needed increases for State and Tribal Historic Preservation Offices, which are expected to face increased workloads from federally mandated project reviews associated with the recently passed infrastructure bill, and increases to critically important competitive grant programs. The letter requests:

- $65 million for State Historic Preservation Offices (SHPOs)

- $34 million for Tribal Historic Preservation Offices (THPOs)

- $35 million for the Save America’s Treasures Grant Program

- $24 million for African American Civil Rights Initiative Competitive Grants

- $12 million for competitive grants for Historically Black Colleges and Universities

- $12 million for the Paul Bruhn Historic Revitalization Grants

- $10 million for the Semiquincentennial Grant Program

- $5 million for the History of Equal Rights Competitive Grant Program

- $3 million for Underrepresented Communities Grants

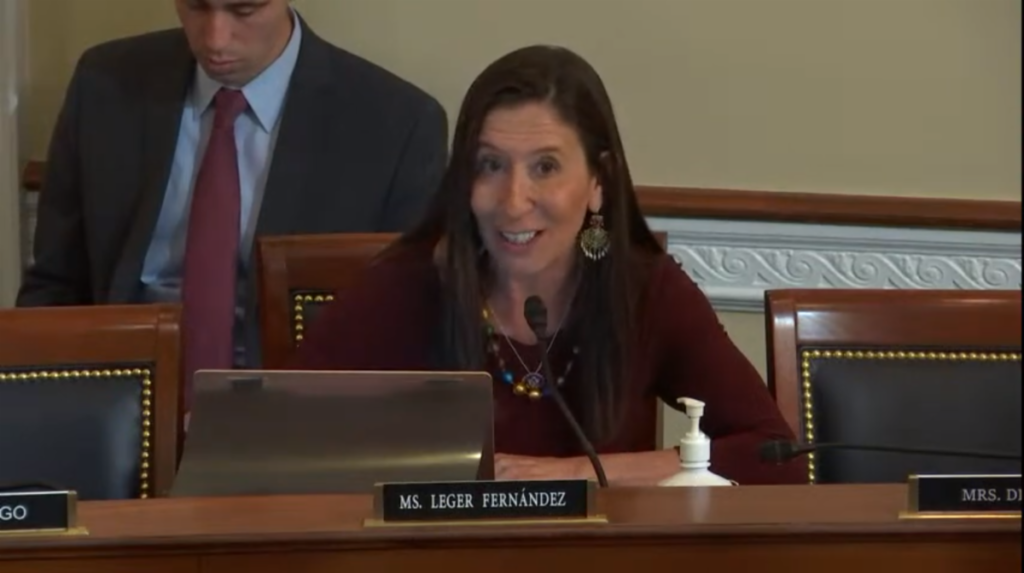

The letter will be submitted to the Senate Appropriations Subcommittee on Interior, Environment, and Related Agencies and marks a strong commitment to protecting our historic resources for future generations. Congress needs to hear from preservation advocates.

Reach out to your Senators and urge them to sign-on to the bipartisan FY2023 Historic Preservation Fund dear colleague letter being circulated by Senators Gillibrand and Cassidy. The more support we can demonstrate for the HPF, the better positioned it will be in the appropriations process.

If you have a personal contact in your Senator’s office, contact that person directly, especially if you just met with their office during Advocacy Week, and urge them to sign-on to the HPF dear colleague letter. If they do not handle Interior Appropriations please ask that they pass the message along to the Interior Appropriations staffer. Preservation Action has also made it easy for you take action. Check out our action campaign to easily edit and send a letter to your Senators today! Also be sure to share this alert with your networks. The deadline for signatures is COB, Monday, May 23rd. Take action today!