Volume 27, Number 10, April 05, 2024

1. Annual Economic Report of the President Highlights the Federal Historic Tax Credit

2. Supreme Court Refuses to Hear Cases That Could Have Limited Presidential Authority Under the Antiquities Act

3. Legislation Would Substantially Improve Michigan’s Historic Tax Credit- Take Action!

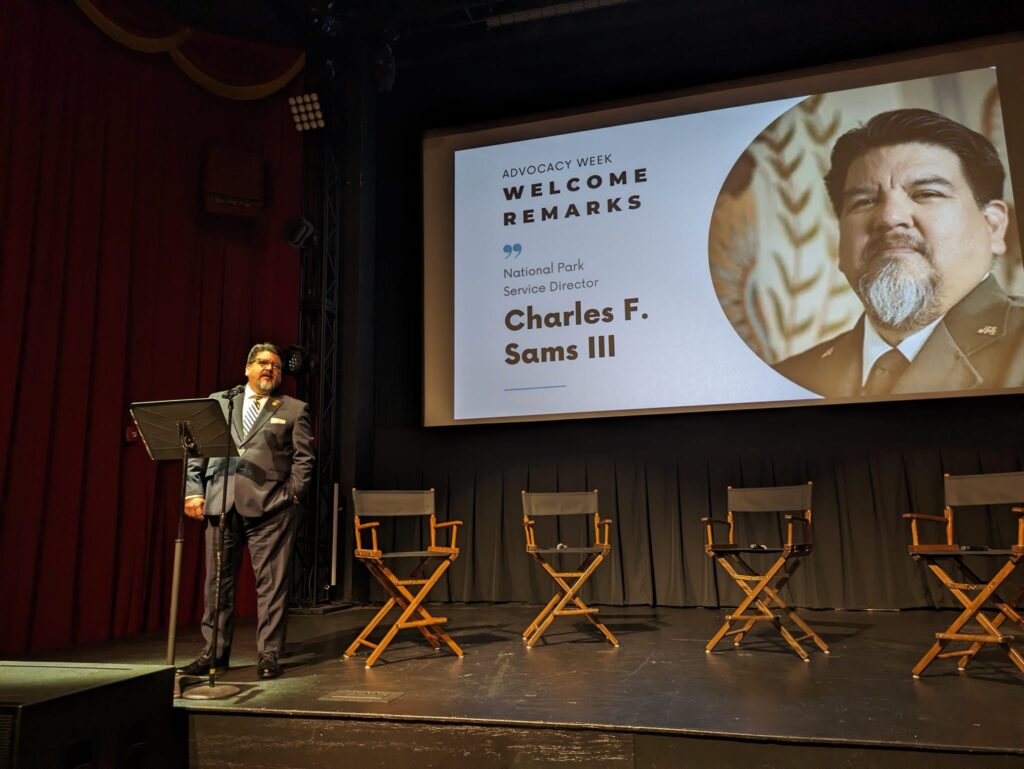

4. Last Chance: Complete Your Preservation Advocacy Week Follow-up and Hill Reports

5. Stories From Around the States